child tax credit 2022 qualifications

22 hours agoFor tax years 2021 and 2022 taxpayers also got increased premium tax credits for all income brackets and the law reduced the health insurance premiums they would be required. The recipient was only getting an amount of 1400 per child.

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Ad The new advance Child Tax Credit is based on your previously filed tax return.

. This means that next year in 2022 the child tax credit amount will return. The american rescue plan increased the amount of the child tax credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age. The Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

There was a partial refundability in child Tax Credit till 2020. A married couple who has one qualifying child under the age of 6 may qualify for a total 2021. A 70 percent.

Here is what you need to know about the future of the child tax credit in 2022. Instead of the entire credit being claimed on a familys tax. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of earned income to qualify for that. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

The Child Tax Credit is not claimable at every income level. To qualify for the EITC a qualifying child must. You may claim the Earned Income Tax Credit EITC for a child if you meet the rules for a qualifying child.

Changes to the Child Tax Credit for 2022 include lower income limits than the original credit. In the meantime the expanded child tax credit and advance monthly payments system have expired. The total child tax credit is 3600 annually for children under age six and 3000 for children ages six to 17 with an income cap of 150000 for couples who file jointly.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. See Important Updates on the Advance Child Tax Credit Payment for Tax Year 2021. The expanded child tax credit by comparison provides 3600 for.

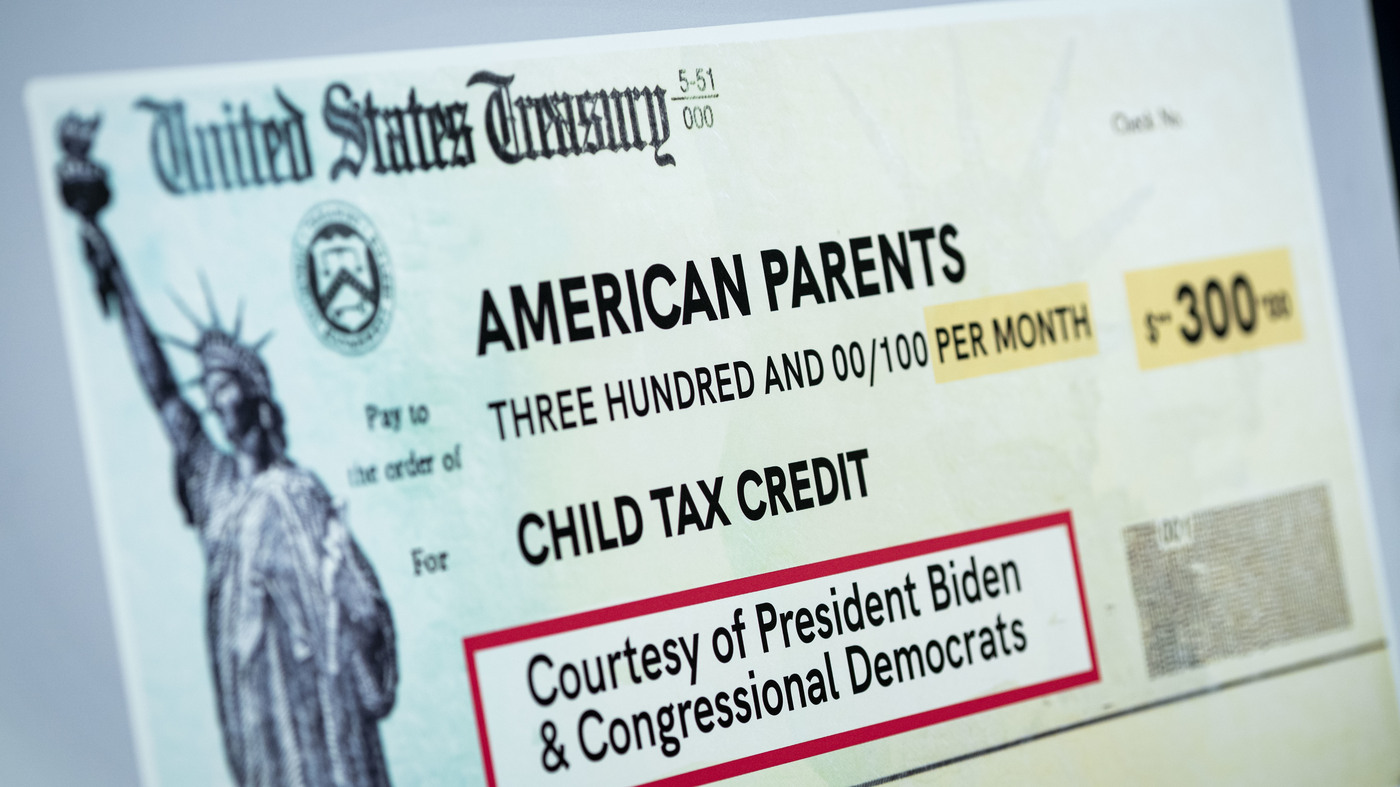

Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year. The expanded Child Tax Credit by comparison provides 3600 for each child under six and 3000 for children between 6 to 17. 3600 for children ages 5 and under at the end of 2021.

Income thresholds of 400000 for married couples and 200000 for all other filers single taxpayers and heads of households. Tax Changes and Key Amounts for the 2022 Tax Year. Have a valid Social.

In 2022 the credit dropped to its previous level of 2000 per qualifying child younger than age 17. The american rescue plan increased the child tax credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under. 3000 for children ages 6.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. A 2000 credit per dependent under age 17. The stimulus bill increased the child tax credit to 3600 for children under 6 and 3000 for those 6-17 from 2000.

Married couples filing a joint return with. The advance is 50 of your child tax credit with the rest claimed on next years return. Further to get the benefit the taxable person should.

To qualify for the child tax credit you need to have supported the child for at least half of the previous tax year. People who are eligible for a partial amount of Child Tax Credit. Families who do not qualify under these new income limits are still eligible to.

The Additional Child Tax Credit or ACTC is a refundable credit that you may receive if your Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an. Additionally the child needs to have lived with you for at least six months of the previous year. Parents must be working or looking for.

The first one applies to.

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

The Child Tax Credit Toolkit The White House

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

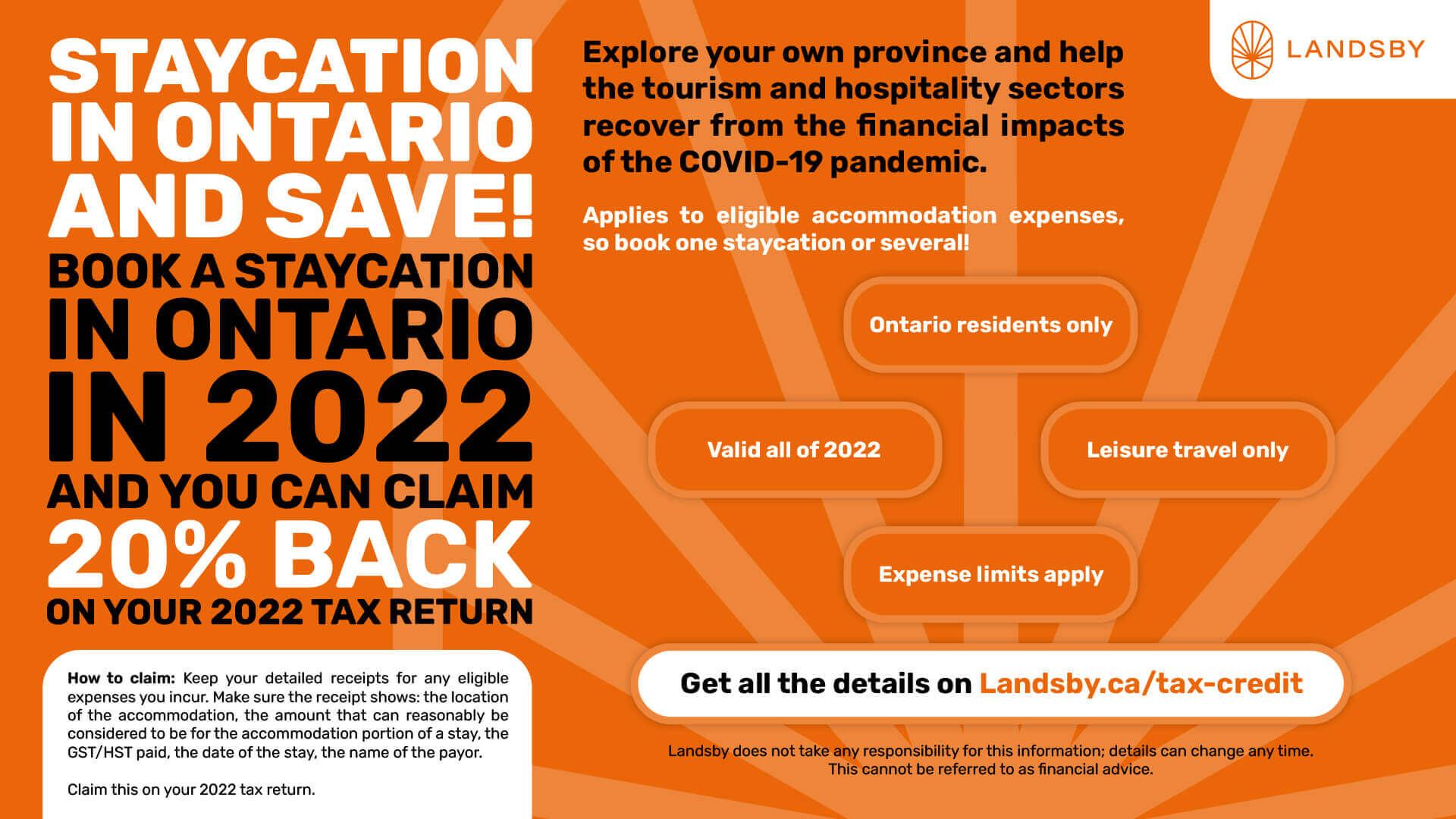

2022 Ontario Staycation Tax Credit Guide Landsby

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Here S Who Qualifies For The New 3 000 Child Tax Credit

The Child Tax Credit Toolkit The White House

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2021 2022 Explained And What It Means For Your Taxes Thestreet Turbotax Youtube

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2022 Payment Schedule Three States Are Offering Checks Up To 1 000 Is Yours Giving Extra Cash

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

What Families Need To Know About The Ctc In 2022 Clasp

Here Is Why You May Need To Repay Your Child Tax Credit Payments Forbes Advisor